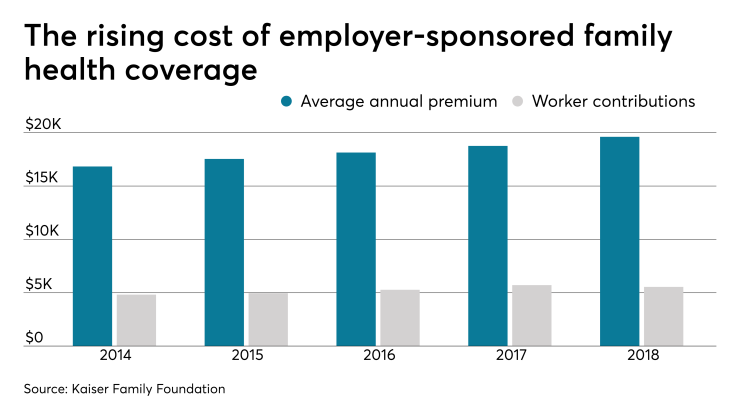

LAS VEGAS — As healthcare costs rise, employers are increasingly looking for ways to offer workers better quality care at more reasonable prices.

Reference-based pricing could be one of those options for self-insured employers and although it has been around for some time, not many are familiar with it.

Reference-based pricing refers to pricing outside what is set by traditional insurance carriers. Provider reimbursement is based on a percentage of what Medicare would typically pay the provider, which often ranges from 120% to 170% of Medicare reimbursement, according to consulting firm Business Benefits Group.

See Also:

However, the complexities of reference-based pricing may be keeping advisers from suggesting it to their clients and employers may not be educated enough to implement themselves.

“We all know there are carriers out there in the traditional fully insured world that are making 10 times what Medicare pays,” said Tracy Keiser, CEO of consulting firm The Keiser Group, during Employee Benefit Adviser’s Workplace Benefits Mania conference. “Well if I’m being charged $100,000 for whatever the service is when it should have been $10,000, I’m going to be very motivated to at least explore ways to save that money, [especially] as an employer.”

Implementing reference-based pricing can be challenging, Keiser said. It’s a huge workload that requires certain criteria to determine if it is the right choice for an employer.

See also:

“We’re looking for business owners that have a vested interest in wanting to look at the medical side of the expense world of their company, just like they would look at the other expenses,” Keiser said. “Medical insurance and benefits in general has been such a commodity product for so long that they just can’t look at it and say ‘okay, it’s a whatever percent increase, let’s pay it and move on.’”

In order to remain competitive, advisers have to bring true cost savings to the table, Keiser added. Reference-based pricing could be one way to do that. Even if a client ultimately says no, advisers still need to put options on the table.

“Your buyer is your business owner or CFO, the people who deal with the expenses every single day and really understand that this is not just another health insurance renewal,” she said. “We’re changing the dynamic that’s happening here.”