Employers using Alight Solutions software will now be able to give their workers access to wages in advance of payday. The provider of cloud-based benefits administration and HR solutions has partnered with DailyPay, an app that gives workers early access to their earnings.

“This new relationship underscores the fact that daily pay benefits are now becoming a mainstream benefit offering for employers in all industries,” says Jason Lee, CEO of DailyPay.

See also:

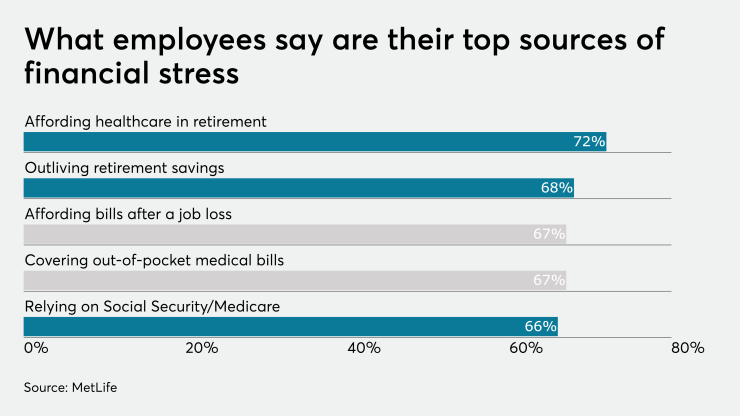

Some employers are turning to instant pay tools as a way to help employees who struggle with financial security. Giving employees instant access to their earned wages can help workers who are living paycheck to paycheck — nearly 20% of Americans don’t save any of their annual income, while another 21% only save 5% or less, according to Bankrate.

However, over the last two years the number of employers offering payroll advances has decreased two percentage points, from 17% in 2018 to 15% in 2019, according to data from the Society for Human Resource Management.

DailyPay will provide Alight users with a calculation of their real-time available balance and employees will be able to transfer their accrued but unpaid wages to any bank account or pay card prior to their next payday. Fees are paid either by employees or employers, if they offer the service as a benefit. The instant pay app will be provided to Alight customers at no additional cost, the company says.

DailyPay is offered as a benefit at about 100 companies, including Vera Bradley,

“Employers have become increasingly interested in offering flexible payment options to meet the needs of their workers,” Craig Cohen, general manager of ADP Marketplace

See also:

Having early access to their earned wages can help safeguard employees against unexpected expenses, and is proven to improve employee retention and engagement, the companies say.

“Alight is focused on helping people and organizations thrive,” says Colin Brennan, executive vice president of human capital management and financial solutions at Alight. “Providing people with access to tools and solutions like DailyPay, which will allow them to manage short-term financial needs in a way that doesn’t create a bigger hardship, helps us achieve that purpose.”