LAS VEGAS — Advisers looking to sell voluntary benefits to their clients may want to consider products that help workers curb financial stress.

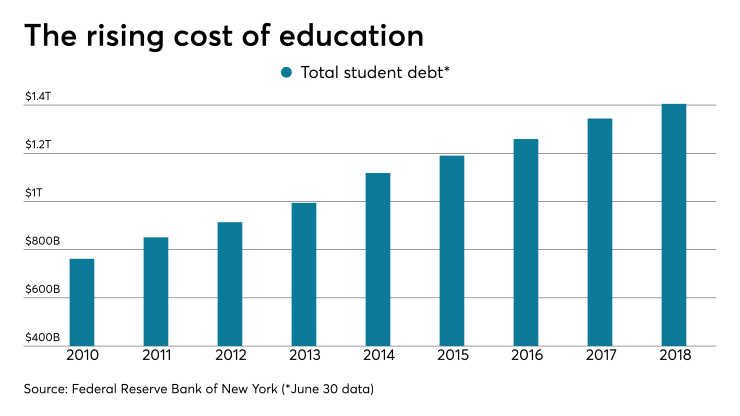

Voluntary perks are attractive assets employers are looking to add to their packages, including student loan repayment benefits, which is a booming voluntary options, said Katie Ott, director of worksite practice with M3 Insurance.

“That market is blowing up,” she said, speaking Monday at Employee Benefit Adviser’s Workplace Benefits Mania conference. “Student loan repayment is a burgeoning trend.”

Indeed, the number of employers offering student loan repayment

See also:

The focus on student loan repayment is just one way employers are shifting toward offering more holistic financial wellness benefits, said Heather Garbers, vice president of voluntary benefits and technology at HUB International Insurance Services. In the past, there was a spotlight on healthcare, but now employers are paying attention to other aspects of worker wellness including financial health.

“Now we’re finding part of making sure employees are healthy is making sure they are healthy as a whole person,” she said. “[There is a] unique opportunity in voluntary benefits to be more strategic about our offerings.”

Newer benefits also mean new administration systems. Advisers need to be conscious to meet clients where they are when implementing benefits technology, Ott said. If workers are used to doing in-person consultations ahead of open enrollment, they may not be so keen on immediately moving to online self-service options.

See Also:

“It’s beholden upon us as advisers and consultants to get them a strategy where they need and want to be,” she said. “It has to be gradual, you can’t rip that Band-Aid off.”

Meanwhile, data shows that employers may need more up-to-date technology. Roughly 70% of employers feel their HR systems were not a fit for the modern workforce and only 9% say their company’s HR technology met expectations,

Advisers need to be thoughtful about the type of tech tools they bring to clients, and how these tools may be used by multiple generations of workers, Ott said.

“Even if they’re not using technology today,” she said. “I want to put them in a place to successfully use technology.”