Nationwide is plunging into the HSA business, joining thousands of banks and financial services firms that are betting that health savings accounts will grow.

The company said this week that it will offer HSA services to 36,000 retirement plans sponsor clients in the first quarter of 2019 in partnership with HealthEquity, a leading HSA provider.

John Carter, president of Nationwide’s retirement plan business, describes the move as the “logical next step” in the company’s long-standing effort to “lead the industry around healthcare costs in retirement through the Nationwide Retirement Institute.”

“This is one more step in how we are addressing what we see as a need every day among the close to 2.5 million participants that we serve,” he says.

Carter touted the company’s experience in developing tools and capabilities to help Americans save for retirement. “We’re very good at engaging participants, we’re very good at enrolling participants and then developing campaigns and digital capabilities that are tailored so that people are taking advantage of the benefits that are available to them,” he says.

Nationwide will design the HSA in a way that will allow participants to track balances along with their 401(k), 457 and 403(b) plans and give them access to education and investment selection, Carter says.

Nationwide joins some 2,600 other HSA providers, including well-known names such as State Farm, Fidelity Investments and Bank of America.

“Competition does not push us away,” Carter says.

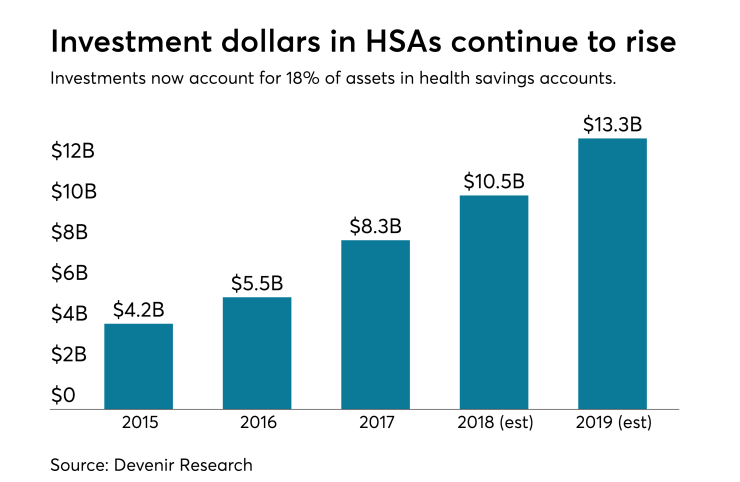

Health savings accounts have posted significant growth as companies encourage employees enrolled in high-deductible health plans to use their HSAs to save for healthcare expenses in retirement. At the end of 2017, there were more than 22 million health savings accounts, holding about $45.2 billion in assets, up 22% from the previous year, according to Devenir, an HSA research and investment services provider.

See also:

Nationwide says it teamed up with HealthEquity due to its strong leadership position among HSA providers.

“As much as we wanted to partner with HealthEquity, they were also looking for a retirement plan provider like Nationwide,” says Hutch Schafer, Nationwide’s business development leader.

HealthEquity will administer Nationwide’s HSA and provide the recordkeeping.

Nationwide declined to say how much the HSA will charge in monthly account maintenance and other fees, saying that it will be disclosed at a later date closer to the launch of the product.

“As we develop the partnership with HealthEquity, we want to make sure we have industry-competitive fees and investments,” Schafer says.