-

CareYaya matches vetted healthcare students with older adults, providing basic care and peace of mind.

February 19 -

With rising costs and limited employer support, working parents say reliable child care is critical to productivity, retention and career stability.

February 19 -

The focus of retirement planning is shifting, according to Morningstar experts, moving away from simple saving toward bespoke decumulation strategies and guaranteed lifetime income solutions.

February 17 -

Dayforce's global head of sustainability and impact shares multiple ways for employers to help workers reverse negative retirement trends.

February 17

-

From physical wellness to financial stability, workers feel and perform better when they use impactful employer offerings.

February 13 -

Direct-to-employer carve-outs can make drugs like GLP-1s more affordable for companies and more accessible for employees.

February 12

-

As costs for care balloon, benefit leaders and employees should be proactive about their retirement saving strategies.

February 11 -

As employees struggle to make ends meet, leaders need to go beyond trendy workplace stipends and address employee needs head-on.

February 10 -

HR leaders can help employees maximize HSA investments, boosting savings for future medical expenses.

February 10 -

UnitedHealthcare's Flexwork program offers hourly employees affordable health coverage, including dental, vision and virtual care.

February 5 -

U.S. workers say financial strain is the biggest obstacle to resiliency, outranking burnout and economic uncertainty, a new survey finds.

February 3 -

A veteran benefits consultant shares how steering employees toward high-performing, cost-efficient providers can improve quality of care while lowering expenses.

January 23 -

A new policy roadmap urges employers and lawmakers to expand retirement access and lifetime income options.

January 22 -

A new report finds rising prices are forcing most U.S. workers to cut back on essentials, tap savings or take on debt, reshaping how they view wages, benefits and job stability.

January 20 -

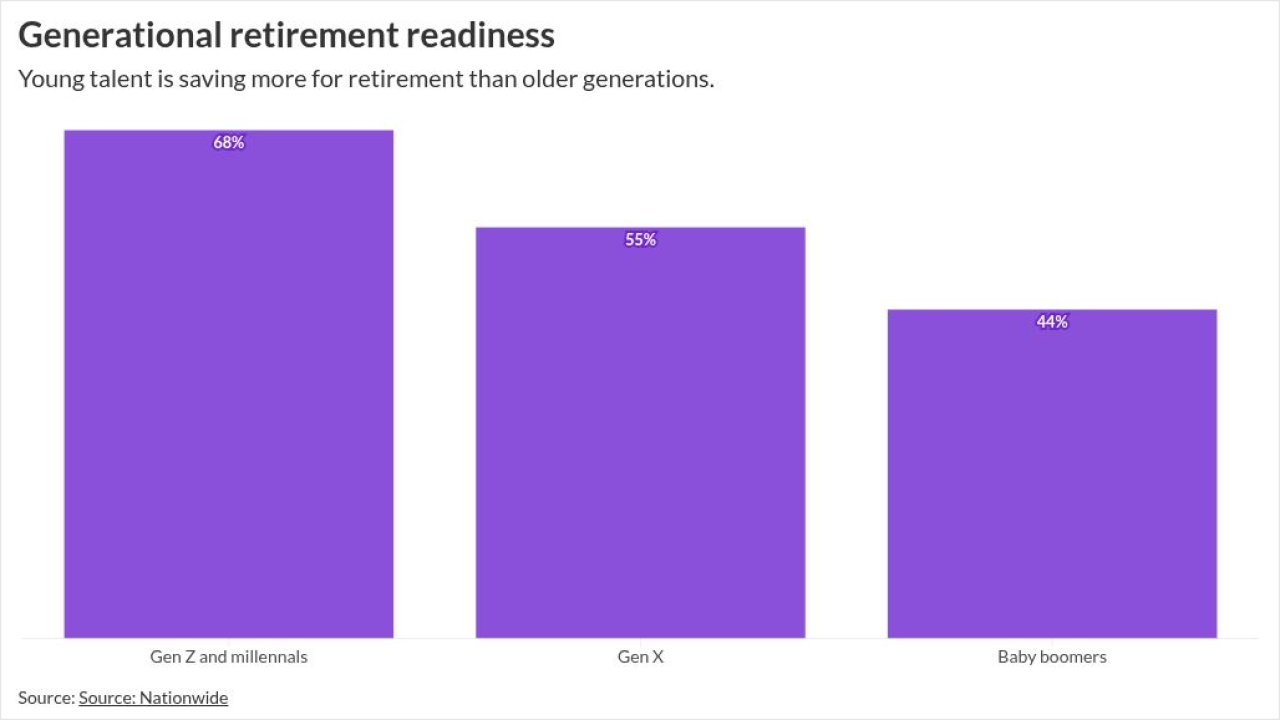

A new report from Nationwide reveals the generational differences when it comes to retirement strategies

January 20 -

High-priced treatments, administered in expensive facilities, are becoming one of the largest cost drivers within prescription plans.

January 20

-

Workers want a more active role in choosing how their benefit dollars are spent, according to a study from Alight.

January 16 -

Developing a plan of action can help HR leaders guide workers through this financially trying time.

January 16

-

Compared to Gen X and baby boomers, younger generations are most knowledgeable about their benefits, but still lack financial wellness support.

January 15 -

A better diet is becoming easier to maintain with medically-approved meals covered by benefits and delivered to people's doors.

January 15