Benefits booklets are ‘worthless’ — and 9 other takeaways from Workplace Benefits Mania

Time to throw away the benefits booklet?

Health and financial wellness needs to become a bigger priority.

HCM systems are ‘the new iPhone.’

‘Referrals are dead.’

Employers and brokers need to get innovative during open enrollment.

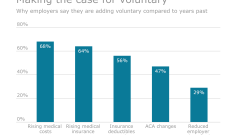

Voluntary market is showing ‘astounding’ growth.

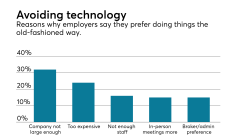

HR professionals need to become technology experts.

Student loan benefits are a hit when it comes to recruiting and retaining employees.

One-on-one benefits meetings aren’t dead.

Benefits professionals: Don’t underestimate how important your job is.