Employers are discovering a new group of employees who are burdened by exorbitant student loan debt: Older employees who are about to retire and are helping to pay their college loans. Add in Generation X and Millennial employees who are foregoing buying a home to pay off college loans, employers are seeking new ways to address this burden on their workers.

Last year, the City of Memphis implemented a student debt repayment program for all of its 8,000-plus employees.

“We wanted an innovative way to attract talent and make us more competitive, if you will, with other agencies,” says Alex Smith, chief human resources officer for the City of Memphis Smith. So far, the program has been success: It has 443 employees participating, who have saved 249 years on their student loan debt for a total of $232,840 saved.

“It has been a pleasant surprise how successful the program has been so far and how helpful it is to our employees,” Smith says.

The average age of those participating in the program is 41, she says, which was a surprise. In fact, employees between the ages of 21 and 64 all seem to have student loan debt.

The city’s employees carry nearly $20 million in student loan debt, but the average salary per year is $45,000. Most are carrying more debt than they make in one year. Smith adds that student loan debt isn’t just a white collar problem but a blue collar one as well. The police department has the most individuals participating in the program to date, she says.

To participate in the program, employees have to work there at least a year and the student loan debt they have must be for themselves and not someone in their household. The city pays $50 per month directly toward the employee’s loan with no lifetime maximum.

Lloyd says that this type of program has captured the most attention from employers, although only 4% of employers offer such an arrangement. One example of this type of program is the employer agrees to pay $2,000 a year for five years toward an employee’s student loan debt. These programs have been well-received by employees.

One negative comment these programs receive is that they are discriminatory toward employees who don’t have student loan debt.

“The reality is that most benefit programs do discriminate and help some people and don’t help others,” says Neil Lloyd, head of U.S. defined contribution and financial wellness research at Mercer. Medical benefits, for example, tend to benefit the sick more than they do the healthy.

College debt before retirement, buying a new home

Craig Copeland, senior research associate for the Employee Benefit Research Institute, says that not only can student loan debt impact a person’s defined contribution plan balances, it can also affect their ability to purchase a home.

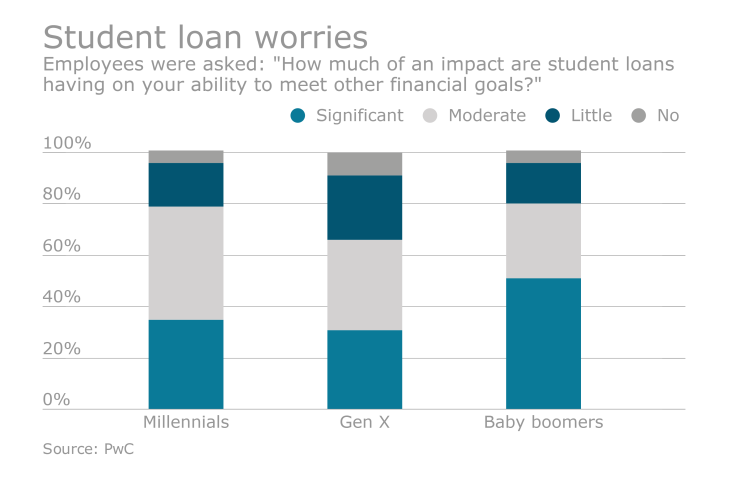

Since 1992, the percentage of families with student loan debt has nearly doubled from 10.5% to 22.3%, according to the Federal Reserve’s 2016 Survey of Consumer Finances. Nearly half of all those under the age of 35 have student loan debt and even one-third of the 35 to 44 age group have student loans.

Even though the numbers have gone way up for the younger generations — in large part because college tuition has gone up so much — Copeland says that the student loan debt crisis “is not just a young person problem.”

He points to the fact that almost 20% of those ages 45 to 54 have student loan debt. The loan could be for themselves, having gone back to school for an advanced degree, or maybe they decided to get another bachelor’s degree because they are changing careers. A large part of the older generation is holding student loan debt on behalf of their children or grandchildren, at the expense of their own retirement savings.

The median monthly payment on a student loan is $200 or 3% of family income. For those with high student loan debt, many are paying more than $600 a month for student loans.

The 2016 Survey of Consumer Finances shows that the percentage of different generations who own a home differs greatly on whether or not they have a college degree or only some college and between those with and without student loan debt.

For those ages 45-54, who have a college degree, nearly 85% own a home if they don’t have student loan debt compared with only 75.7% of those with student loan debt. For those younger than 35, only 42% of people with a student loan and a college degree are homeowners compared to 45% with no student loans.

As the unemployment rate goes down, employers are searching for ways to attract and retain talent. Many workers have said they are interested in educational or financial wellbeing programs that will help them better manage their debt. Others said they would love it if their employers found a way to help them pay off their student loans.

A new match plan

Another idea that is gaining traction in the marketplace is a student loan 401(k) match. As part of a traditional 401(k) match, the employer places a set percentage of money into an individual’s retirement account based on their own level of contribution to the plan. In the case of a student loan 401(k) match, an employer agrees to put a matching contribution into a person’s 401(k) plan based on how much that individual is spending on their student loans each month up to a set amount per year.

This type of program can be expensive for the employer and the amount set aside in a participant’s retirement savings account must still abide by federal contribution limits.

Employee Benefit Adviser’s annual conference delved deep into innovative enrollment tips, employee engagement and hot workplace offerings.

Another downside to offering a direct student loan payment is that it will be taxed as part of a person’s salary. That’s why many in the industry are pushing for the matching 401(k) contribution idea because those funds would go in pre-tax. And while the funds wouldn’t go directly toward paying down student loan debt, they would allow those employees to not only pay down their debt but set money aside for retirement at the same time.

The Internal Revenue Service recently approved Abbot Laboratories’ new benefit, the Freedom 2 Save Plan, which will allow full- and part-time workers who qualify for the company’s 401(k) plan to set aside 2% of their pay to pay off student loan debt but still qualify them for the company’s traditional 5% match to the 401(k) plan. They don’t have to contribute that 2% to the 401(k) to receive the matching contribution.

"Our employees have invested a lot in themselves to earn their way into Abbott, and we don't want student loans to prevent them from beginning to save when time is on their side," says Steve Fussell, executive vice president for human resources at Abbott. "With this program, we're changing the retirement savings formula. If you’ve got old school debt, we've got new-school retirement investing."

Others in the industry are hoping that the IRS decision in the Abbott case will pave the way for other companies to offer the same type of program.

Pointing out that student loan debt can have a lasting impact on a person’s defined contribution plan balance, particularly as they get older, Copeland says that there is little relief in sight from the colleges themselves.

“Student loan debt is increasing and will continue to increase,” says Copeland.